How To Make Your Money Work For You – 10+ Best Methods

For many, the idea of making money while you sleep probably sounds like an absolute dream come true. And personally, I love exploring new passive income ideas that help accomplish this exact goal.

The reality is that it's possible to get your money to work for you even if you're starting with a modest investment amount.

So, if you're wondering how to put your money to work to start creating new income streams, this is absolutely the post for you!

Want some easy ways to make your cash produce more cash? Checkout:

- Discover Cashback Checking: Earn 1% cash back and ditch bank fees with this debit account!

- Motley Fool Stock Advisor: Get professional stock recommendations and learn how to invest like a pro!

How To Make Your Money Work For You

1. Invest In Income-Generating Real Estate

One of the most common ways to make your money work for you is to invest in income-generating real estate properties.

And the great news is that you don't have to be a millionaire or become a landlord yourself to do this thanks to real estate investment companies.

For example, real estate investing companies like Fundrise pool money together from investors and invest in real estate properties like multi-family homes and commercial real estate.

From there, Fundrise earns regular rental income and pays back investors through quarterly dividends.

Historically, Fundrise returns about 8% as well, and you pay 1% in annual management fees.

Arrived is a similar company that also invests in income-generating assets, except it specializes in individual rental properties and vacation homes.

Overall, real estate investing is a way to create a new income stream for yourself, and again, you don't have to be a millionaire to start out.

So, if you want to make money work for you, you can always consider these sorts of real estate investing companies!

Learn more about Fundrise and Arrived!

Disclaimer: This is an endorsement in partnership with Fundrise. We earn a commission from partner links. All opinions are my own.

2. Invest In Stocks & ETFs

Like investing in real estate, regular investing in stocks and exchange traded funds (ETFs) is another way to have your money work for you.

You also have a lot of options here for how you start and what you invest in specifically. Personally, I'm focusing a lot on growth stocks, U.S. ETFs, and dividend-paying stocks these days.

But you can explore so many different types of investments and portfolio compositions. And, of course, you can always speak to a financial professional to get advice for your unique situation.

That said, the actual process of investing is also very straightforward. For example, you can usually invest in stocks and ETFs for free through your bank's brokerage account.

And if you can't you can always use commission-free brokerages like M1 to begin investing.

But if you want to get your money to work for you, investing in valuable companies, index funds, and ETFs is certainly one common strategy to accomplish that goal.

Pro Tip 💵 Get 50% off The Motley Fool Stock Advisor program and join over 500,000 investors receiving professional stock recommendations and tips right to their inbox!

3. Get Out Of Debt

Many ideas for making your money work for you involve creating a new income stream.

However, lessening your financial burdens and becoming debt free is one of the best ways to put your money to work.

After all, if you're spending a fortune on monthly interest or late payment fees, it's incredibly hard to get ahead and begin building wealth.

Creating a monthly budget should be the first step here. This is because it's critical to know where every dollar you spend is going so you can save more money and spot any problematic areas of your budget.

I did this while I was in college, and I quickly learned that my alcohol and entertainment budget allocation was way too high, so I cut back.

Personally, I budget with a simple Excel spreadsheet. However, you can use plenty of budgeting apps like Rocket Money or Mint if you need assistance.

Aside from that, coming up with a debt repayment plan is also a smart move.

Some people prefer the debt snowball method, which involves paying off your smallest debts first and then moving onto the larger ones.

In contrast, other people use the avalanche method, which involves tackling your nastiest debts first and then working your way down.

You can decide which method is right for you. But if you're trying to make money work for you, becoming debt free is definitely one of the first steps to take.

4. Start An Online Business

While this isn't the most obvious way to put your money to work for you, starting an online business can be an incredibly lucrative investment.

And I have a personal example that I think highlights this very well.

One of my college side hustles was to start WebMonkey. At the time, I spent around $150 on a WordPress theme, my domain name, and SiteGround hosting.

That was back in 2018. But just four years later in 2021, WebMonkey made $92,000.

My income mostly came from affiliate marketing and Mediavine advertisements, but it goes to show how investing in an online business can yield massive returns if you put in time and effort.

But making money with a blog is just one example, and there are plenty of other online business ideas you can try.

Some popular online businesses you can start to create additional income include:

- An online coaching or courses business

- Making money with a YouTube channel

- Starting a podcast

- Starting a Shopify ecommerce store

- Selling print on demand products on Etsy or with websites like Redbubble

Again, these ideas require upfront work and a lot of work to get up and running, but if you outsource more of the work, you can basically earn income on autopilot.

And I firmly believe that funding an online business is one way to get your money to work for you that has the highest income potential.

5. Invest In Cryptocurrencies

If you're still wondering how to make your money work for you, you can always consider investing in alternative assets like cryptocurrency.

Crypto investing has been all the rage these days, and it's actually one new income stream I'm experimenting with.

For starters, you can use popular crypto exchanges like Coinbase to invest in popular cryptos like Bitcoin, Ethereum, and Solana.

From there, Coinbase lets you stake different coins to earn passive income, so you can put your digital assets to work immediately.

For example, I've started using Nexo, a crypto interest account, to earn passive income with some Cardano (ADA) I own.

Nexo lets you buy and deposit dozens of different cryptos, and it can easily pay 10% to 15% APY or more on your holdings; much more than any high-interest savings account can.

Right now, I'm earning about 6% APY with my Cardano. Overall, Nexo was very fast to set up and is a nice little new project I can keep tabs on.

Again, crypto is an emerging space, so you have to do your due diligence and never invest money you can't afford to lose.

But if you want to make your money work for you and feel like exploring digital assets, crypto is definitely a viable option.

6. Invest In Small Businesses

Like investing in stocks, another idea to put your money to work is to help fund different small businesses.

But you don't need to be a venture capitalist or have access to secret deals to do this.

With companies like Mainvest, you can actually help fund dozens of small businesses across America and then share in profits as a shareholder.

Mainvest only requires $100 to begin investing, and the platform lets you invest in a range of businesses like:

- Cafes

- Breweries

- Farms

- Real estate developments

- Restaurants

Mainvest aims for 10% to 25% returns for investors, but some opportunities aim to double your money for helping to fund a growing small business.

What's nice about Mainvest is that the company has a strict vetting process and only accepts around 5% of applicants, so you find quality businesses that just need funding to keep growing.

Mainvest also includes in-depth documentation and SEC filings to help you do your due diligence.

Overall, this is a more alternative way to invest and make money work for you. But if you want to help fund small businesses and potentially earn some handsome returns, Mainvest is worth considering.

7. Invest In A New Side Hustle

Another idea to get your money to work for you is to invest in an asset that lets you start a new side hustle.

You can also get very creative here, and many ideas don't require an immense amount of capital to start.

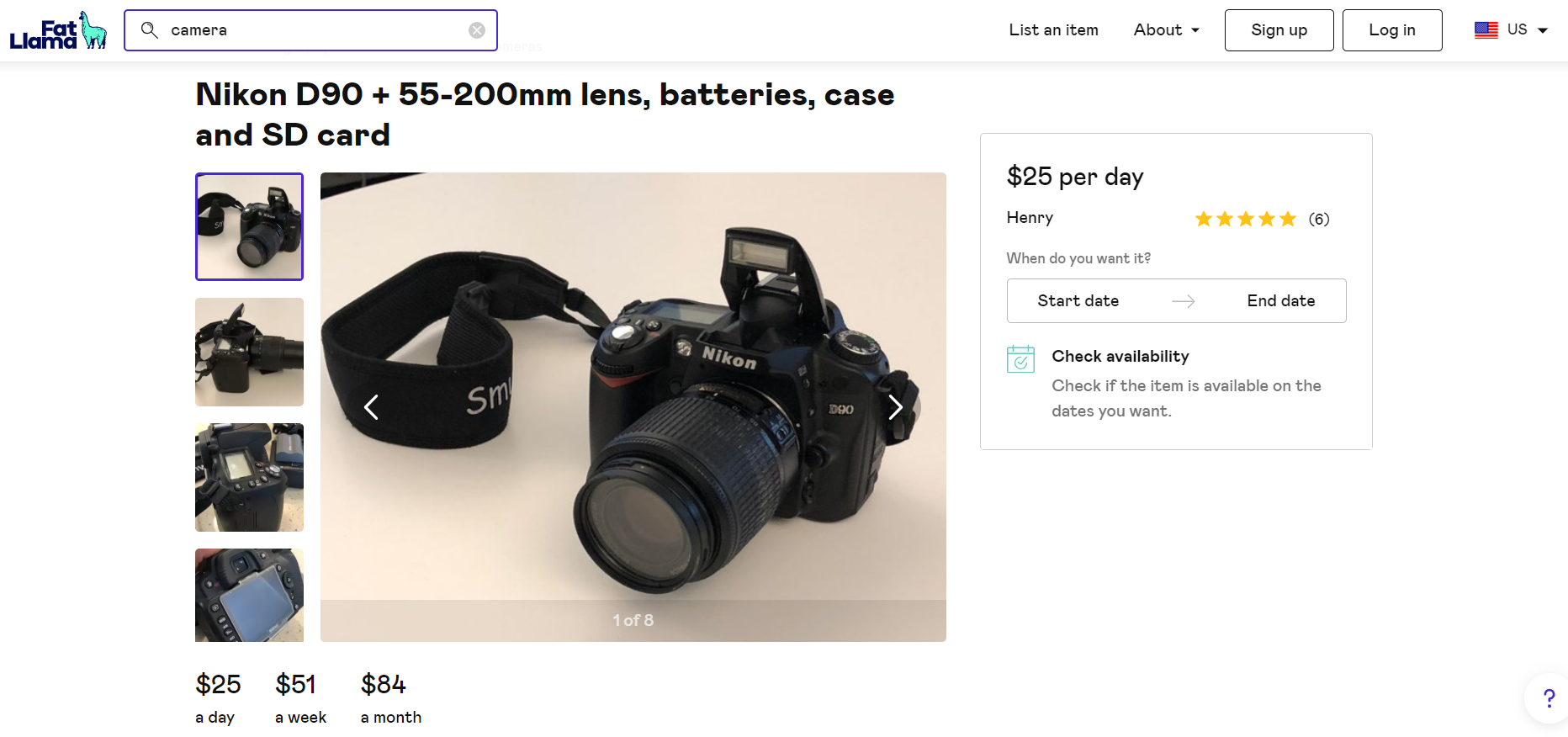

For example, one idea is to invest in things you can rent out for money.

People often do this by upgrading a spare room and renting it through Airbnb, but you have plenty of other options like renting out:

And again, this can become incredibly lucrative if you find the right rental market.

For example, people are renting out equipment like cameras and drones on Fat Llama for around $25 to $100 per day depending on the type of equipment.

So, if you spend money upfront and invest in these assets, you can turn around and rent them out to begin recouping your money. Anything you make after that point is pure profit.

And this is just a rental example; nothing stops you from investing in some other small business idea that you can use to make extra money every month.

8. Learn A New Skill

If you want to put your money to work, you can always consider investing in more education to learn a skill that helps you make more money down the line.

Going to college or university is the prime example here, although you don't have to pay tens of thousands of dollars to learn potentially life-changing skills.

For example, there is so much free and amazing information online that can teach you basically anything you need to know.

This is how I learned how to blog, and I never bought a course or paid for a mentor; I just learned through trial and error, hard work, and free information.

Plus, online education platforms like Udemy have affordable courses on almost anything you can think of.

Want to learn how to make money programming? Or want to become a graphic designer, or web developer?

You can learn all of these skills on Udemy, and many courses are $15 to $100 at most.

Granted, this isn't an obvious example of how to get your money to work for you.

But if a single course helps you land a higher-paying job or start a profitable business, it's well worth the investment and time.

9. Invest In Rental Properties

Like real estate crowdfunding, another option that can earn money while you're sleeping is to invest in your own rental property.

The main downside to this method is that you need enough starting money for a down payment. Additionally, being a landlord isn't a piece of cake, and dealing with tenants requires ongoing work.

But many people get into the landlord business by buying properties like Duplexes and then renting out one of the rooms.

The beautiful part about this strategy is you're paying off your mortgage with rental income. And you can always move out down the line and rent out both units.

Again, real estate crowdfunding options like Fundrise are much more beginner friendly.

But if you want to invest $200k or some large amount of money, a rental property could be the perfect fit.

10. Try Flipping Your Money

One of the oldest ways to make your money work for you is to flip your money by buying and reselling goods.

People have been doing this since currency has been around, and flipping is still an incredibly popular side hustle these days.

For example, people are making money online now through retail arbitrage, which involves buying popular products and then reselling them online with programs like Amazon FBA.

And people are selling all sorts of things through retail arbitrage, with popular products including:

- Apparel

- Books

- Cosmetics

- Electronics

- Home goods

- Toys

- Video games

Usually, sells purchase discount inventory from sales sections in stores like Walmart and Kohl's, but if you find a deal, you can try to flip that item online for profit.

And Amazon FBA is just one option for flipping merchandise.

Other popular selling apps and marketplaces include:

- Mercari: A popular selling app where you can sell just about anything.

- Poshmark: One of the best ways to sell shoes, accessories, and clothing online.

- Facebook Marketplace: Perfect for selling stuff in your neighborhood for cash.

- SidelineSwap: One of the best websites for selling used sports equipment or new equipment as well!

Overall, this method of putting money to work requires time to source products and to learn which products sell quickly and for a good profit.

But if you're interested in starting a side business, you can definitely try this side hustle and start out small by flipping $500 or $1,000 or some similar amount.

11. Open A High-Interest Savings Account

If you want a very simple way to have your money work for you, you can always park your extra cash in a high-interest savings account.

These days, most interest rates for savings and checking accounts don't even beat inflation.

But with online-only banks, you can usually find some pretty decent interest rates and even sign-up bonuses. For example, Current is a mobile banking solution that pays 4% APY and even has a nice $50 bonus for new members!

12. Use A Cash-Back Credit Card & Reward Apps

When you spend money, you can use a variety of tricks to recoup some of your spending as cash-back rewards.

In turn, this lets you make your money work for you since even when you're spending, you're at least working towards future rewards.

Using a cash-back credit card is the perfect example, and you can usually earn at least 1% to 2% cash back for your everyday spending.

But you can take things one step further by incorporating popular reward apps into your shopping routine to earn even more rewards.

Some leading reward apps you can use include:

- Fetch Rewards: A leading grocery reward app that pays you for shopping with free gift cards for shopping.

- Drop: My favorite rewards app that pays you for shopping online at your favorite brands.

- Swagbucks: This rewards platform pays you for playing games, shopping online, and uploading your shopping receipts.

- Receipt Hog: Another way to earn free PayPal money and gift cards for uploading shopping receipts.

- Amazon Shopper Panel: Lets you earn free Amazon gift cards for uploading your shopping receipts.

- Upside: Lets you save up to $0.25 per gallon at thousands of gas stations across the United States.

Apps like Fetch Rewards and Drop are my favorites, but you can use a combination of apps to earn as much as possible.

This strategy won't make you rich overnight, but it's a reliable way to earn free money and to keep more of your money in your wallet without much work.

13. Invest In Fixed-Income Investments

If you're looking for security but still want to make your money work for you, you can always consider fixed income investments.

Two common examples of this involve investing in bonds or certificates of deposits (CDs).

Generally, these investments pay you a fixed rate of return in exchange for locking up your money for a specific amount of time (known as the maturation date).

In the past fixed income investments like bonds were a way people saved for retirement, and you can still explore different corporate or government-backed bonds.

Granted, this isn't my favorite idea to put your money to work because bond and CD returns are pretty low, and during periods of high inflation, this definitely isn't what you want.

14. Consider Alternative Investments

One final method to get your money to work for you is to invest in various alternatives investments.

I already mentioned cryptocurrency, but there are even more asset classes you can turn to if you want to invest and make money daily.

Some popular alternative investments include:

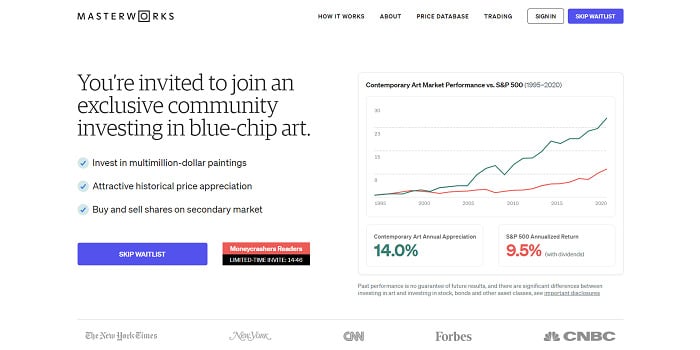

- Investing in artwork with Masterworks

- Investing in farmland with Acretrader

- Buying a blog or ecommerce website through a marketplace like Flippa

- Investing in fine wine with Vint

The bottom line is there are plenty of asset classes where you can park your capital to get your money working for you.

Just make sure you do your due diligence and research before picking an alternative investing idea!

Tips For Getting Your Money To Work For You

Now that you know how to get your money to work for you, here are a few tips you can keep in mind to make this process much easier and likely to succeed!

- Set An Income Goal: I think it's important to set measurable goals when working towards something. So, decide how much additional income you want to earn so you can pick a way to make your money work for you that makes sense.

- Diversify: It doesn't matter if you're investing with Fundrise, renting out assets for cash, buying a rental property, or using Coinbase to stake crypto; don't be afraid to try a few methods so you find out which one works best for you!

- Have Realistic Expectations: Getting money to work for you is a great feeling, but it can't always happen overnight.

Extra Reading – How To Turn $10,000 Into $20,000.

Frequently Asked Questions

What Does It Mean When Money Works For You?

Making your money work for you means investing your money into something where it generates additional income. In this sense, you're using your money to make more money, accelerating your wealth building process.

How Can I Grow My Money Fast?

If you want to make money fast, ideas like starting a side hustle or online business can generate returns the fastest. This is because more traditional investing ideas like stocks, ETFs, and mutual funds generally have more conservative returns.

And if you need quick money today, you're probably better off using gig economy apps like DoorDash and Instacart to make cash today instead of trying to invest.

Final Thoughts

I hope our guide on how to have your money work for you helps you deploy your capital so you can earn extra income every month!

Again, as long as you set goals and do your due diligence, there's no reason why you can get your money working for you.

Personally, I'm sticking with online businesses, crypto, and regular investing for this year.

But thanks to the power of technology, there are so many different ideas out there, so don't be afraid to explore!

Looking for even more money-making ideas? Checkout: