Passive Income vs Active Income – Which One Should You Prioritize?

These days, it seems like everyone is obsessed with building a passive income stream. I mean, who doesn't love the idea of making money while you sleep?

However, as enticing as this concept is, the reality is that much of the money we all make can be considered active income, or money you earn by giving time and energy to complete some type of service.

So, how do you decide between developing passive income or active income? Well, I'd argue there are some pros and cons to each type of income source, as well as some misconceptions surrounding the entire thing.

So, today we're going to break down passive income vs active income, why this matters, and ideas for how (and when) you should get started with each.

Difference Between Active And Passive Income

Passive income involves generating income through assets or investments that require little to no effort to keep running. In contrast, active income involves trading your time for money in work that's directly compensated by the effort you put in.

Oftentimes, active income is much higher than passive income at the start. However, passive income has the potential to grow over time through compounding. It's also a popular tactic to diversify one's income.

Generally, building wealth through active income is easiest at the start. As you develop an active stream, you can shift some of your income to establish passive streams that generate money on autopilot for the future.

What Is Passive Income?

According to Wikipedia, passive income can be defined as “income that requires little to no effort to earn and maintain.”

Wikipedia als goes on to state that passive income is actually “called progressive passive income when the earner expends little effort to grow the income.”

Now, I personally prefer to lump both of these income types under the same umbrella, and I think this is largely where people get confused about what passive income really is.

Nothing in this world is really 100% passive.

At some point in time, you need to expend energy and time to obtain assets, be it money, a new business, investments, or some other type of income-generating asset. Additionally, you'll inevitably have to spend some amount of time checking in on things, as well as brain power to plan out the whole thing.

However, I don't think this upfront work requirement means that this is all a scam or get-rich-quick scheme. Passive income is important. It's one of the best ways to invest upfront energy and resources to ensure that you get paid for months or years to come.

Examples Of Passive Income

There are a few broad categories of this income type that are worth considering.

Again, some of these take different amounts of upfront work and monitoring than others, so you need to choose a category that makes sense for your income goals and amount of free time.

1. Passive Income Apps

I’ve covered reward apps before on WebMonkey, and they definitely have a soft spot in my heart. While reward apps like Drop and Rakuten require pre-selecting offers to earn cash back rewards, other apps are more passive.

In fact, you can actually turn your smartphone into an income source with these passive income apps:

- Pogo: Earn PayPal cash whenever you shop and share your data with Pogo.

- Bridge Money: Another passive income app that pays you whenever you shop.

- MobileXpression: Earn free gift cards by sharing your data.

- Dosh: Automatically earn cash back for shopping at over 100,000 locations across the United States.

- Honeygain: This app lets you sell Internet bandwidth to earn.

I've used all of these apps since my time in college. In my experience, earning $10 to $30 a month or so with a combination of these apps is quite realistic.

2. Investing

As mentioned, sometimes developing a passive income source requires upfront work to start building an asset. In the case of investing for income, this means expending energy to acquire money that you use to invest.

Typically, people put their money to work with dividend paying stocks or ETFs if they’re looking to build recurring income. This is because dividend payments are reliable if you invest in companies that historically pay out dividends to shareholders.

You can also invest in exchange traded funds that focus on growth and still pay dividends. Whatever the case, this is one the most straightforward ways to put your money to work for you. And it's also an excellent passive income stream for young adults.

If you want to get started with investing, you can always open a zero-fee online brokerage account. Stash is a great example and is one of the more popular investing apps in the United States. And it even has a nice $5 sign up bonus to sweeten the deal.

3. Real Estate

Another classic example you can turn to is real estate income.

Now, there are a few different ways to approach this. One option is to buy a rental property that you rent out to tenants. If you have the capital for a downpayment and know what you’re doing, this is a viable option. You can also rent out an existing space you own or a spare room on websites like Airbnb.

This is also fairly passive because you can leave keys in a lockbox and communicate to renters through Airbnb’s website so they can check themselves in.

Finally, you can also invest in real estate by using platforms like Arrived.

Arrived lets you invest in shares of income-generating rentals and vacation homes. It then pays shareholders with quarterly dividends from rental income, and you can also earn if your shares appreciate.

What's nice about Arrived is that it only takes $100 to begin investing. So, this is a beginner-friendly way to earn passive income. And Arrived's team handles everything from finding tenants to building maintenance.

4. Rental Income

Another classic passive income example is to rent things out for profit.

Again, people might complain and say this isn’t truly hands off because you need to obtain assets to rent and then deal with renters each time. However, I’d argue that this is still mostly passive, and you can successfully rent out assets and generate a profit while you sleep without much upfront work at all.

Some classic examples of things you can rent out include:

- Vehicles with websites like Turo or HyreCar

- Instruments on websites like Fretish

- Clothing on Rent My Wardrobe

- Extra storage space with a company like Neighbor

- Parking spaces

- RVs by using RV Share

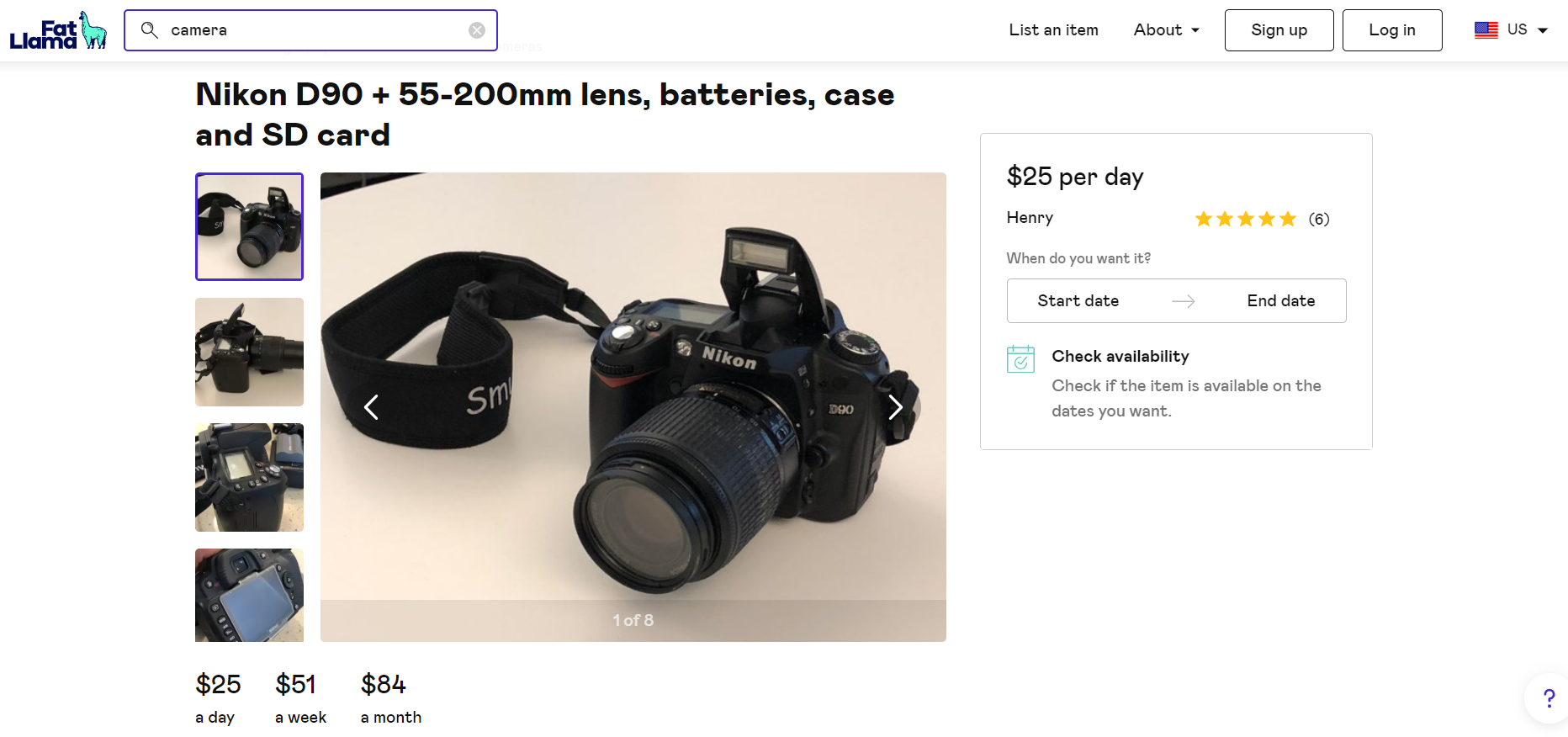

There’s truly a range of assets you can rent, and if you’re looking for inspiration, you can also checkout general rental marketplaces like Fat Llama.

Fat Llama insurers renters with up to $25,000, and you can find a wide range of categories for rent on this U.S. and UK marketplace.

5. Other Passive Income Sources

If you’re still looking for inspiration, here are a few other ideas you can turn into a new income stream:

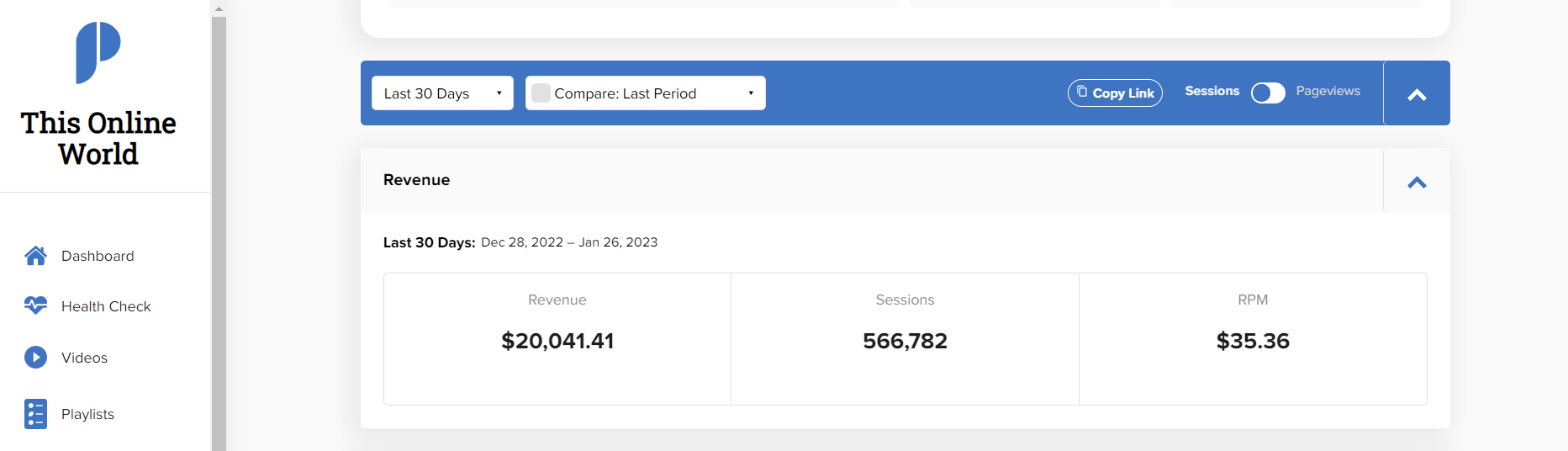

- Start A Blog: While it takes incredible upfront work, a blog can turn into an income-generating asset through display ads, affiliate income, and sponsored posts.

- YouTube: Like blogging, a YouTube channel can earn some serious income through ads and affiliate income if you rank on YouTube and get regular views. Checkout our post on how to make money on YouTube to learn more!

- Print On Demand: Create your own Etsy print on demand store and sell merchandise without ever having to ship or manufacture it!

- Sell Online Courses: Websites like Udemy let you create and sell courses to keep a percentage of profits. If you’re an expert in something, a course could earn income for years to come.

Again, a lot of people would argue that these aren’t passive because they require work, but I disagree. After all, passive income is all about reducing the amount of work you put in over time.

Plus, you never know where an idea can take you. As a personal example, WebMonkey now makes $20,000 a month or more between Mediavine ads and affiliate income. And in 2022, it made $272,000!

Pros & Cons Of Passive Income

Pros:

- Diversifying your income

- Compound growth potential

- Accelerating your path to financial freedom

- A theoretically unlimited income ceiling

Cons:

- Many ideas require significant upfront time requirements

- Upfront capital requirements

- It isn’t always possible to outsource everything

- Might be a distraction (more on this later)

What Is Active Income?

According to Investopedia, active income is defined as “income received from performing a service, and includes wages, tips, salaries, commissions, and income from businesses in which there is material participation.

This is much less exciting than making money while you sleep, but this is unfortunately why active income doesn’t get enough attention.

After all, you need resources to build passive income, and the only way to obtain resources in the first place is to put in active work. So, in many ways, active income is the foundation for everything you do in the future of your finances, and this is why it’s so important.

Examples of Active Income

There are several classic types of active income you can use to boost your income immediately.

1. Your Salary

This is the most straightforward type of active income. In a nutshell, you can think of your 9 to 5 job as exchanging time for money.

In reality, your salary can be broken down into an hourly rate. Therefore, one of the best ways to build wealth is to work to secure a high salary out of school and to also work towards steady promotions. Alternatively, you can job hop every few years to secure a better salary.

A raise of $5,000 is pretty significant if you think about it, and you can of course secure even larger raises or new positions that increase the effectiveness of this active income source.

Extra Reading – The Best Legit Online Jobs That Pay Daily.

2. Gig Jobs

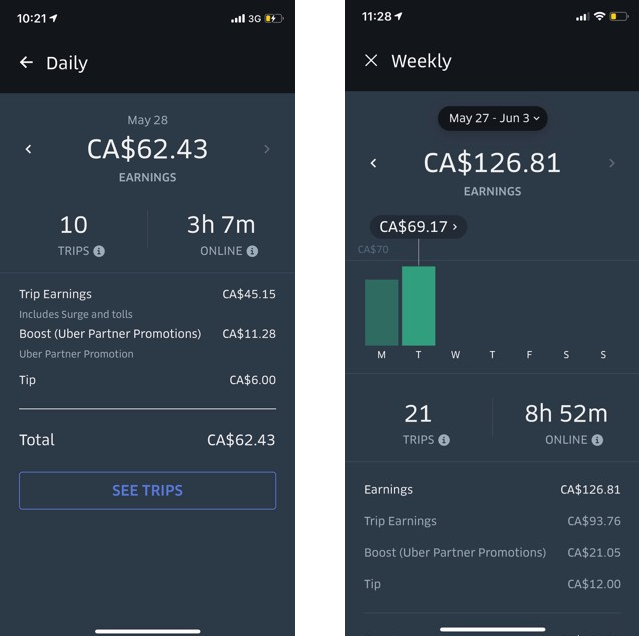

Gig economy apps are another common way people expend time for money. And while this route has less growth potential than a salary (since you can’t get raises), the gig economy is useful if you need to make money in a pinch.

Examples of popular gig jobs include:

- Driving for Uber or Lyft

- Delivering groceries with DoorDash or Uber Eats

- Walking dogs with Rover

- Completing handyman tasks with apps like TaskRabbit

- Delivering groceries with Instacart or Shipt

Most gig jobs have a pretty strict earning ceiling, meaning your hourly rate will probably cap at between $10 to $20 per hour with most of these gigs.

However, the advantage of the gig economy is that it’s flexible and there’s constant demand, so you can work as your own boss.

Start making money with Uber Eats!

3. Part-Time Jobs

Starting a part-time job is another reliable way to develop a new active income stream.

Is a second job worth it? Well, if you have enough free time and need the extra income, it’s not a bad idea. Plus, you can always use proceeds from a part-time job to start out a passive income stream, like a modest investment portfolio.

4. Commission

If you have a sales job or work actively as an affiliate, this is another form of active income.

During my time at an advertising agency, a large portion of my take-home pay was commission based. This meant that some months were rather lean, and then highly profitable months were very lucrative.

Ultimately, this is one of the active income sources with the most explosive potential. After all, if you earn a commission for selling something expensive, like real estate agents do on properties, this could amount to thousands of dollars per hour of your time.

5. Tips

While this might not sound like active income, it really is.

Think about it. As someone in the service industry, the quality of your service directly translates into the tips you get. You have to put in work, and the more energetic and friendly you can be, the higher likelihood you get a decent tip.

Pros & Cons Of Active Income

Pros:

- You get an instant return on your effort (or every two weeks or so from your paycheck)

- Income is fairly stable

- You can use the income you get immediately for other ventures

Cons:

- You only have limited hours and energy in the day

- Salaries have a ceiling

- As you get older, active income becomes less appealing

Is Passive Income or Active Income Better?

Active income is better than passive income for making an immediate improvement for your finances. It's also how most people build up the resources to create passive income. However, in the long-run, creating passive income streams can surpass active income streams due to compound interest and time.

That said, the main reason I wrote this post is because I think people are too obsessed with the idea of passive income.

Don’t get me wrong, I’ve loved it too ever since I started phone farming in college. However, ever since I quit my job and started freelancing full-time, I realize the power of growing your active income as quickly as possible.

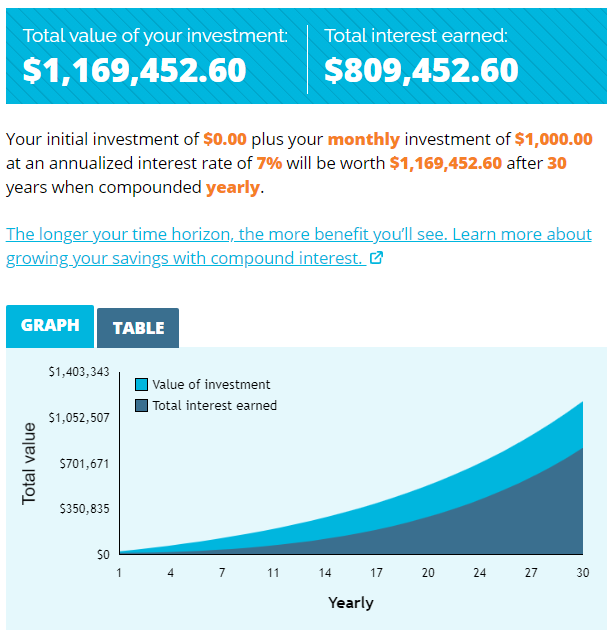

I mean, just consider what happens if you put in more active income work and generate an additional $1,000 per month.

Let’s also assume you invest that money each month and expect a 7% annual return for your efforts. In 30 years, you end up with more than a million dollars.

This is absolutely insane, but it demonstrates the power of compound interest and side hustles. And compound interest is, ultimately, why active income is so powerful if you do the right things with it.

Now, if you’re already making great money, you can start to put that money to work and dabbling with passive income ideas like investing.

If you’re living paycheck to paycheck or hate your job, don’t even bother with passive income until you can develop an emergency fund and find a job you actually enjoy.

That’s just my two cents, but I think it needs to be said. There’s no point in looking into passive income ideas if your active income has immediate room for growth.

You can always put your money to work in the future, so don’t sweat it if you need to work on the fundamentals first.

Final Thoughts

At the end of the day, I think the FIRE movement has really got people thinking about how they can become financially free. This is absolutely awesome, and I personally love the school of thought.

However, I also think the whole passive income vs active income debate is a bit of a weird one. The simple fact is that a high-paying job is the fastest way to start building your first passive income streams.

As you age and get tired of working, you can shift your focus into more hands-off sources of income and work a little less.

Hopefully, this post has helped break down some of the pros and cons of each income type and some ideas for getting started!

Want more ways to make money? Checkout: